Our New App Helps Sell Regulated Products

IntuitSolutions developed Excise Tax Manager to improve the process of selling regulated products online. Some products subject to excise tax include tires, alcohol and tobacco. Excise taxes can be imposed from any level of government, from municipalities all the way up to state or federal government. Prior to the development of the Excise Tax Manager, there was no solution for sites on BigCommerce trying to sell these products, and charge applicable taxes. IntuitSolutions has developed this app to automatically calculate and charge excise tax with accuracy, directly in the BigCommerce Checkout.

Destination Based Product Fees App

This app is the most popular solution for charging excise tax, but also has many other applications. The app allows you to charge a fee for any product in your store, based on the destination of the product.

Across the United States, different states have required a collection of Tire Excise Tax. New tires sold, mounted, and installed can be subject to the excise tax in some states. The excise tax applies to new tires for cars, buses, boat trailers, construction equipment, motorcycles and much more. Our app clearly displays and records the excise tax separately from all default sales taxes.

Learn More About Tire Fees

Currently, merchants do not have say over additional fees on regulated products. For example, the tire fees are mandated at the state level and go to programs to help with tire waste. Every state has different tire fees and the destination based product fees app helps calculate and clarify the tire fees at each state level.

When consumers purchase tires, there is usually a line item – “Tire Recycling Fee.” The fee can be unclear to customers purchasing new tires. The fee is also referred to as tire disposal fees, waste tire recycling development fees or scrap tire disposal fees. Below are examples of different tire disposal fees, recycling and environmental fees.

Environmental Fees

When consumers purchase new tires some states charge environmental fees. The fees are meant to fund research and development on recycling old tires. The fees support the discovery of more uses for used tires to lessen the amount of US tires that are illegally discarded.

Tire Disposal Fees

The tire disposal fees are in place to help disposal service or companies to handle recycling of old tires. The service or company has licensing requirements and is trained to dispose of tires.

Federal Excise Tax (FET)

The federal excise tax (FET) fee is only applied with the purchase of very large truck tires, and is calculated by the weight of the tire itself.

How Does Our Tire Fee App Work?

Once the app is installed on a BigCommerce site, merchants will follow a step by step guide on how to configure the appropriate taxes for their products. Taxes can be added and applied to groups of products, and will be calculated based on defined geographic zones.

Create a ‘Product Group’

BigCommerce merchants can create a ‘Product Group’ by choosing Product Categories or individual Products from the BigCommerce product database. Merchants will group their Products based on the excise taxes that will need to be applied.

Create a Geographic Zone

The complexity of excise taxes comes from the multitude of laws that can be applied at nearly every level of government – from municipalities to counties to states to federal. In order to comply with laws from all of these regions, we’ll need to create geographic zones that correspond to the excise tax zones.

Apply Excise Tax Rates

Merchants will pair Product Groups and Geographic Zones, and apply a tax rate with a number of important variables.

First a new Rule will be created. Rules can be named according to their application, specific excise tax, etc. This rules name will be what is displayed to your customers at checkout when excise tax is applied to an order.

Then select your Product Group from a dropdown list, and choose the ‘Fee Frequency,’ which can be per SKU, per Product, or per Order, depending on how exactly the excise tax is calculated. Then enter the taxable portion. Sometimes only a portion of a product is taxable, but in most cases this will be 100%. Finally, add a brief description, and submit your new rule.

Once a new Rule has been created, a Rate can now be created and applied. Add a Rate to your Rule by choosing the Rate Type and Rate Value (percentage or flat rate), and then choosing the Zone to which this Rate should be applied. Complete this process for all combinations of taxable products and their destinations, and excise tax will be added to the Order.

The Benefits of Using Our Destination Based Product Fees App

Flexibility of Configuration

The Excise Tax App for BigCommerce is a flexible application that enables merchants to charge excise tax for most tire disposal, recycling and environmental fees.

- Applies taxes based on SKU, Product, and/or Order

- Defines unique geographic zones

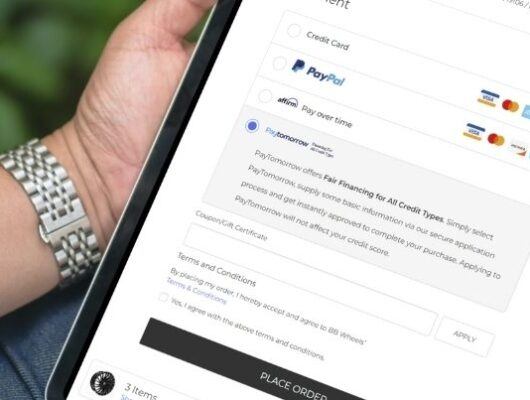

- Easily integrates to the existing BigCommerce checkout, so customers never leave the BigCommerce checkout

Customization For Each Product

Our customization enables you to set every product’s tax rate in each zone that you configure.

- Charge based on flat rate, percentage of product price, or percentage of taxable portion

- Saves time for accounting, order processing, etc.

Clearly Display Excise Tax

The excise tax is accurately displayed for the user as a line item and automatically included in the grand total.

- Customers can clearly understand what they’re paying for in the checkout

- Excise taxes is displayed and recorded separately from all default sales tax charged on an order

Compatible & Secure

A truly effective application works well with the other systems and applications in its ecosystem, and the Excise Tax Manager is no exception.

- Our solution is compatible with most other BigCommerce apps, including (most importantly) apps like Avalara and TaxJar

- Meets PCI Compliance standards with the BigCommerce checkout

Other Apps To Consider When Selling High Risk Products Online

More IntuitSolutions’ apps for selling high risk products online:

- Shipping Restrictions – product and customer group based shipping restrictions

- Chargify Commerce – Setup and manage your subscriptions right in your BigCommerce dashboard

Sell Tires Online? You Need This App Today

Do you have a solution for charging excise tax? Don’t pay more down the line when you get hit with penalties. Our developers build apps specially designed for merchants like you who sell regulated products. Invest in your business’ future – contact us today to schedule a demo and see what Excise Tax Manager can do!

Call us at +1 866 590 4650 or Contact Us today!