-

- Buy Now, Pay Later (BNPL) options continue to surge in online shopping, offering flexible installments and low interest rates.

-

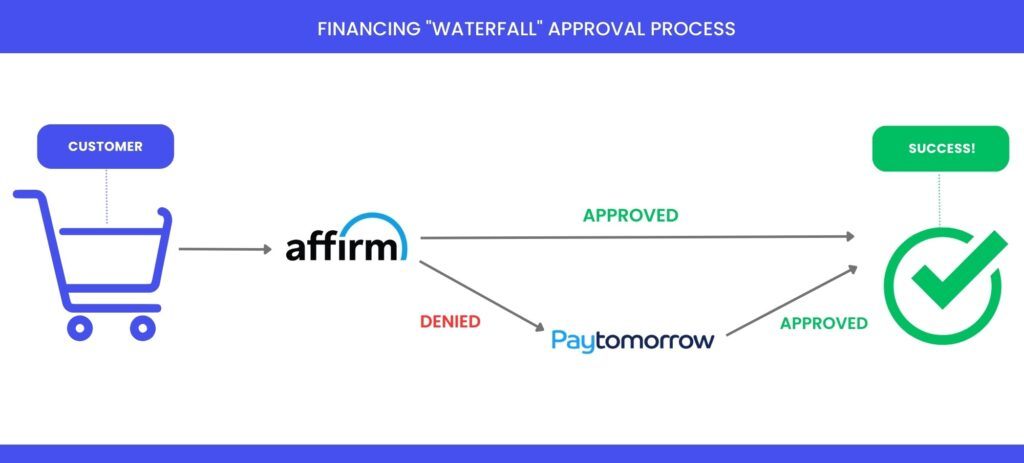

- Since approval odds will vary depending on creditworthiness, ecommerce merchants often choose to integrate multiple financing options in their website’s checkout.

- A custom-developed solution for one of our clients lets applicants denied by their primary financing option automatically receive a secondary offer.

- Since approval odds will vary depending on creditworthiness, ecommerce merchants often choose to integrate multiple financing options in their website’s checkout.

The Rise of Buy Now Pay Later (BNPL) and Flexible Financing Options

Great UX brings shoppers to checkout—flexible payment options keep them there. Are you offering payment options that seal the deal?

A recent study by Bread Financial found that 90% of consumers consider payment flexibility important, and 60% say it directly influences their decision to buy.

Buy Now Pay Later (BNPL) options, also referred to as “Point of Sale (POS) financing,” are becoming increasingly popular in ecommerce. More than 14% of Americans reported using a BNPL service in 2023—a trend that was exacerbated by the pandemic, with many shoppers short on cash.

Why BNPL is Gaining Popularity in Ecommerce

Even shoppers that don’t experience financial difficulties appreciate the additional options in financing their online purchases. Unlike credit cards, BNPL options typically have flexible installments, limited fees, and little to no interest rates.

For ecommerce merchants, integrating Buy Now Pay Later (BNPL) options into checkout isn’t just a convenience—it’s a strategic advantage that can drive revenue and customer loyalty.

BNPL can help by:

- Turning browsers into buyers by removing upfront cost barriers

- Making high-ticket items more accessible with flexible payment plans

- Reducing cart abandonment by offering alternative financing at checkout

- Boosting Average Order Value (AOV) by encouraging larger purchases

- Building customer loyalty through seamless, stress-free payment options

- Gaining a competitive edge over merchants that don’t offer BNPL

The Challenge: Integrating Multiple Financing Options for All Credit Types

What happens when a shopper gets denied financing at checkout? They leave.

To prevent lost sales, ecommerce merchants are increasingly implementing multiple BNPL options—ensuring that if one provider declines, another can offer an alternative. That’s exactly what our client, BB Wheels, set out to achieve.

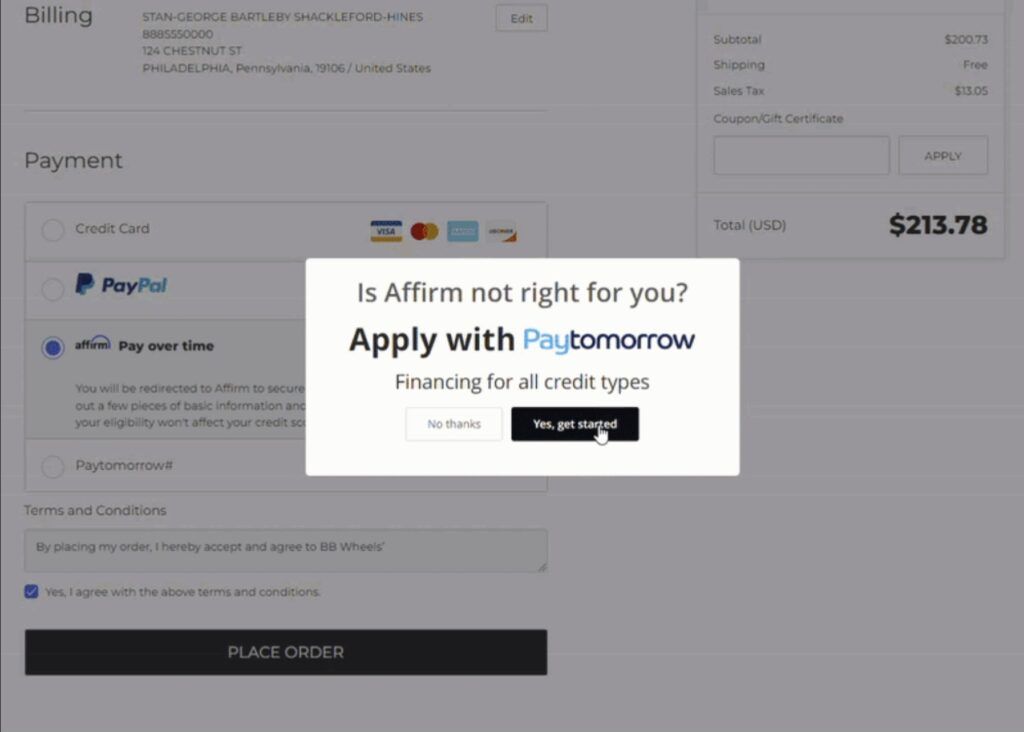

BB Wheels wanted to enable a real-time financing approval process within the checkout page to serve shoppers of all budgets and credit backgrounds. This called for a custom-developed solution that communicates the denial of one financing option to trigger a prompt for an alternative.

The solution included:

-

- Two different BNPL financing options, Affirm and Paytomorrow, integrated with their BigCommerce checkout.

- A custom “waterfall” process that gives customers denied by their initial choice another path to purchase through a second option with more lenient approval odds.

The Solution: Custom BigCommerce Checkout with Primary and Secondary BNPL Options

Our team developed a custom BigCommerce checkout flow that seamlessly redirects customers denied by Affirm to an alternative financing option, PayTomorrow, ensuring more shoppers have access to flexible payment solutions.

How It Works:

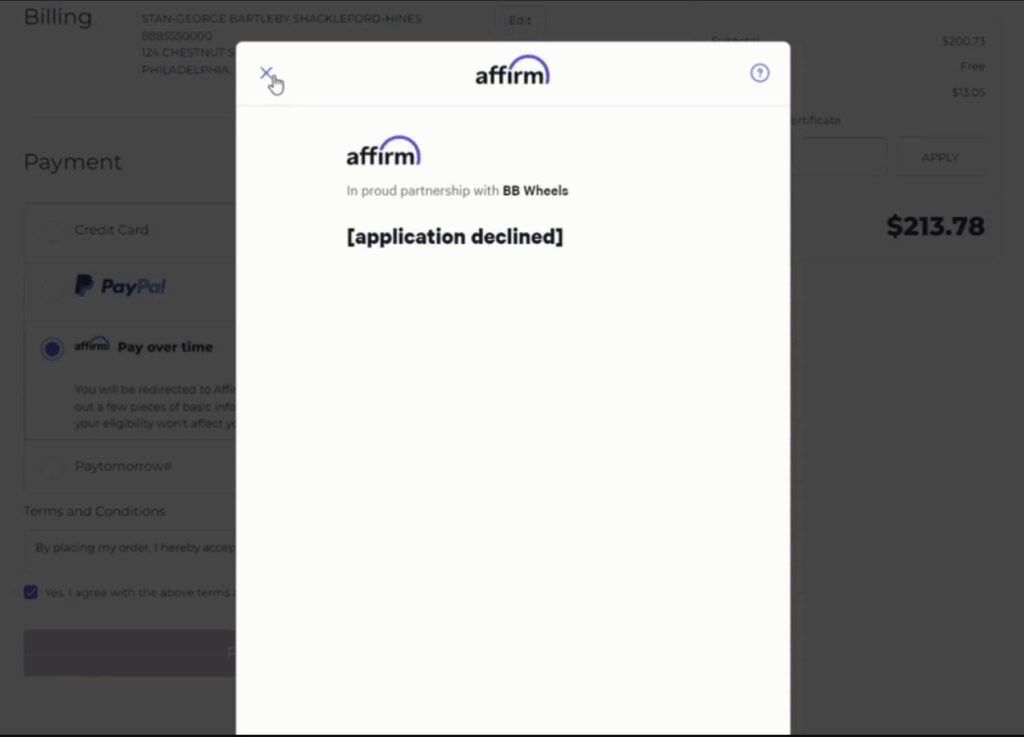

- Customer selects Affirm at checkout and completes the standard application process.

- If Affirm declines the application, the popup closes automatically.

- An alternative financing prompt appears, inviting the customer to apply through PayTomorrow.

- If the customer accepts, their payment method is updated to PayTomorrow.

- The PayTomorrow modal opens when the customer clicks “Place Order,” allowing them to complete the transaction with the secondary financing option.

Start Improving Conversions with Custom Buy Now Pay Later Options for BigCommerce

Offering Buy Now Pay Later isn’t just about convenience—it’s about removing barriers to purchase. By integrating multiple financing options that serve a range of credit backgrounds, merchants can create a more inclusive checkout experience, helping more shoppers complete their purchases and return with confidence.

As an Elite BigCommerce Partner with over 20 years of ecommerce expertise, IntuitSolutions specializes in conversion-driven BigCommerce checkout solutions, including custom BNPL functionality.

Do you have a request for a custom checkout feature? Our experienced BigCommerce Developers would be happy to discuss your project.

Call us at 866-901-4650 or contact us here to discuss your needs today.

Customize Your BigCommerce Checkout

Take control of your customer's checkout experience. See what's possible.