As the digital economy rapidly evolves, offering a variety of payment options—such as credit cards, Buy Now Pay Later (BNPL), and other alternatives—has become essential for delivering a seamless and convenient customer experience. However, while these choices provide shoppers with flexibility, the hidden cost of transaction fees can quietly erode a business’s profits if left unmanaged.

To address this challenge, many merchants are opting to charge fees based on the payment method selected at checkout. Although BigCommerce doesn’t offer native support for payment-specific fees, our team has developed a fully customizable solution that allows businesses to effortlessly manage and apply these charges, protecting their bottom line without compromising the customer experience.

How to Recoup Payment Processing Fees in the BigCommerce Checkout

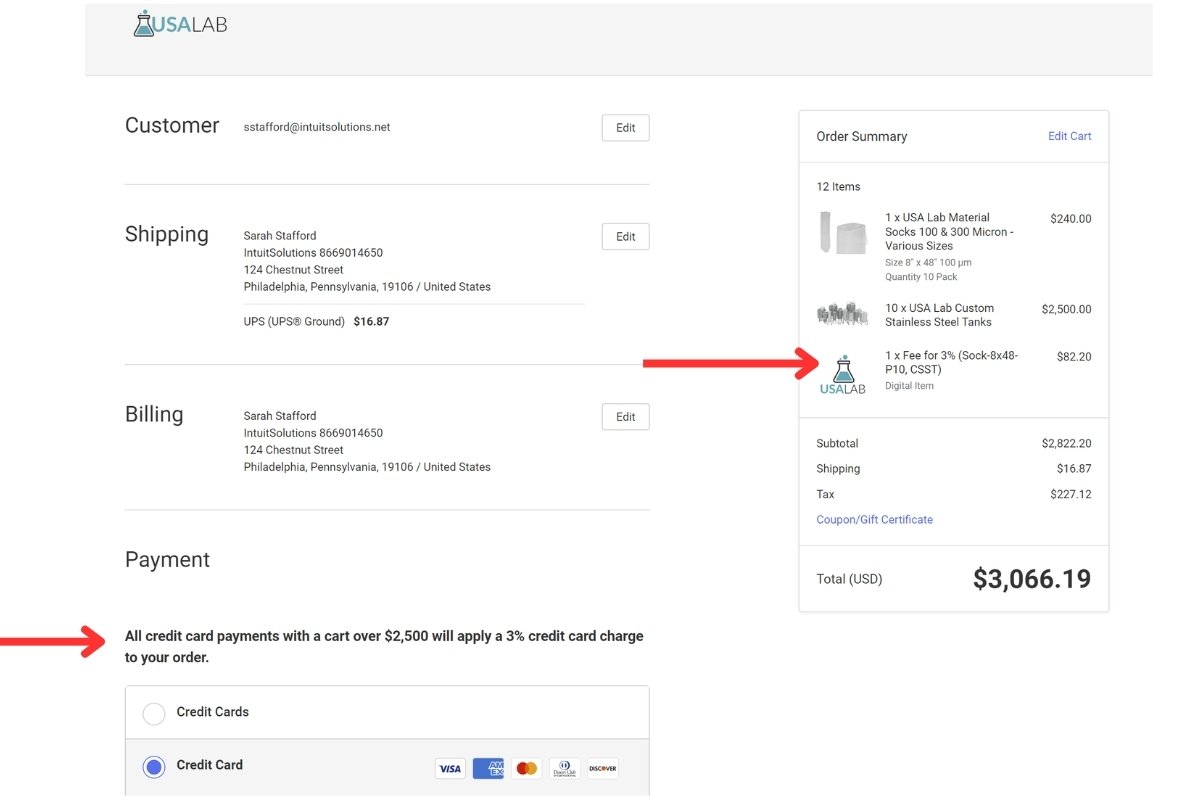

As demonstrated in the example above, BigCommerce merchants now have the ability to apply fees at checkout based on the customer-selected payment method. Powered by the Product Fees Module within the Ebizio Checkout suite, our solution can be customized to suit various payment scenarios, such as:

- Applying a custom fee (percentage or flat) based on payment method and/or order amount threshold

- Assigning the appropriate tax classification for the transaction fee

- Optionally including shipping costs in the transaction fee calculation

- Labeling fees at checkout for customer transparency and business reporting

Merchants also have the option to include custom messaging at various stages of the buying process—such as on the product page, cart page, or during checkout—to inform customers in advance that certain payment types will incur additional fees. This proactive communication helps maintain a positive user experience by setting clear expectations.

Ready to Recoup Transaction Fees?

Take control of high processing fees. Talk to our experts today.

How Much Can Your Business Save by Recouping Transaction Fees?

Payment processing fees can take a substantial toll on your bottom line, particularly for B2B merchants and businesses managing higher order volumes.

By charging customers based on the payment method, you can effectively offset these costs and confidently offer a wider range of payment options that you might have previously avoided due to high processing fees.

Curious about the potential savings for your business? Use the guide below, which uses credit card fees as an example, to guide you through calculating your own transaction costs.

How Much Can Your Business Save? Calculate Your Credit Card Processing Fees

- Visit your BigCommerce Merchant Dashboard.

- Export of your orders over any given period of time.

- Sort orders by credit payment method.

- Add the total of the order values.

- Multiply this number by 0.03 for 3% transaction fees (adjust for your specific fee percentage).

- This is your monthly average transaction fee cost (multiply by 12 to get the annual number).

Enhance Profitability by Recouping Payment-Specific Fees at Checkout

As the digital landscape evolves, managing transaction fees is crucial to maintaining a healthy bottom line. By passing payment-specific charges to customers, merchants can offset costs while continuing to offer the flexible payment options that today’s customers expect.

If you’re interested in optimizing your checkout process or exploring other ways to enhance your BigCommerce store, we’re here to help.

Contact us at 866-901-4650 or submit your project details here to learn how we can support your business goals.

Ready to Recoup Transaction Fees?

Take control of high processing fees. Talk to our experts today.